Many projects have one overall budget that includes all the project labor costs, travel costs, materials costs, etc. This works fine for smaller and medium-sized projects. However, as a project gets larger, it helps to have the overall budget broken down into smaller subsets. This is similar to the concept of breaking down a project with a long duration into a set of smaller projects. Having your budget allocated at a lower level allows you to keep better control of the details, and it may point out potential budget trouble quicker than having everything rolled up into one consolidated project budget.

Many projects have one overall budget that includes all the project labor costs, travel costs, materials costs, etc. This works fine for smaller and medium-sized projects. However, as a project gets larger, it helps to have the overall budget broken down into smaller subsets. This is similar to the concept of breaking down a project with a long duration into a set of smaller projects. Having your budget allocated at a lower level allows you to keep better control of the details, and it may point out potential budget trouble quicker than having everything rolled up into one consolidated project budget.

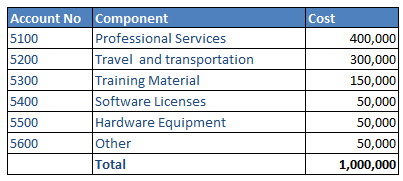

Cost accounts are used to allocate the budget at a lower level. Cost accounts are formally established in your organization's General Ledger so that your budget is actually allocated in each detailed cost account and the actual project expenses are reported at that level as well. The cost accounts can be established in a couple of ways. One way is to simply divide the different types of costs in separate cost account budgets. In this approach, the project manager could have a cost account for internal labor charges, external labor charges, travel costs, per diem costs, training costs, material costs, etc. Typical cost accounts are used to track budget expenses in the NGO financial system, also called the chart of accounts (COA).

- 50XX - Personnel Costs

- 51XX - Professional Services

- 52XX - Equipment Purchases (Expensed)

- 53XX - Materials, Services, and Consumables

- 54XX - Travel and Transportation

- 55XX - Occupancy

- 56XX - Financing/Depreciation/Miscellaneous

- 57XX - Grants/Sub-grants

- 58XX – Contributions in Kind

For example, the project budget can be developed for each cost account.

Another way to set up the cost accounts is based on the WBS. After completing the WBS, the project manager can create cost accounts for each group of related activities. Another option is to set up a separate cost account and budget for each phase, stage, or outcome of the project. This method allows tracking the costs to achieve a specific objective or milestone, something that the other method will not be able to do as it tracks costs associated with accounting codes.

If the cost accounts are for related sets of work on the WBS, the project manager has options to track different costs. The various types of costs can be tracked with sub-account numbers within the cost account. The more detailed the cost accounts are, the more work will be required to set them up and allocating and tracking the cost account budgets. However, if the project is large and costly, the project manager will definitely want to utilize some aspects of this technique.

Want to learn more? Enroll in the next session of our online course, Effective Project Management for Development Organizations and NGOs. Register now and obtain a 20% discount with the promo code 20EPM. Click on the link to find out more about this course. https://www.pm4dev.com/elearn/ecourses/eepm.html